Huawei announced a partnership with digital money transfer service WorldRemit, making WorldRemit's international money transfer service available to all partners of Huawei's mobile money service platform across Africa. WorldRemit is a leading global provider of remittances, processing 74% of all international transfers to mobile money accounts coming from money transfer operators.

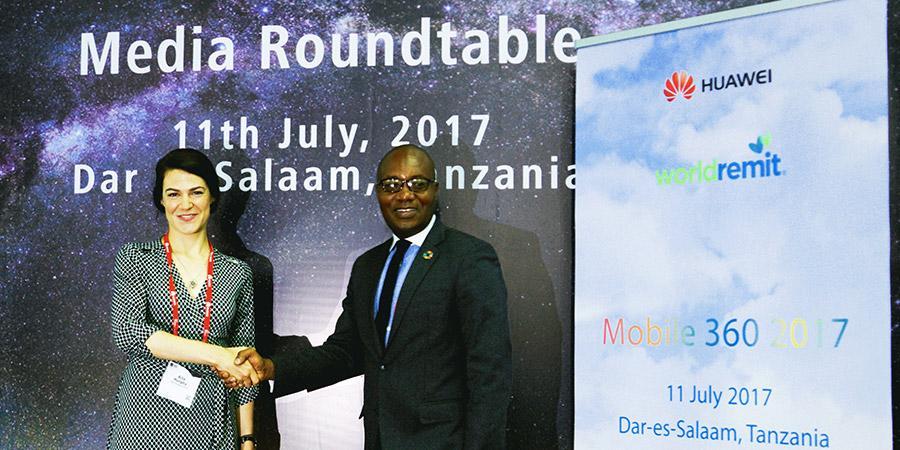

The partnership, which was announced at the GSMA's Mobile 360 conference in Dar es Salaam, Tanzania, enables Huawei to add a ready-made solution for remittances - a growing mobile money product offering - to its existing suite of services. By enabling WorldRemit to connect to over 100 million mobile accounts currently using Huawei's platform, the deal will improve access to mobile money remittance for millions of people.

WorldRemit is the first international remittance company to partner directly with Huawei. The deal is expected to accelerate WorldRemit's technical integrations with new mobile money operators. Technical integration is frequently a barrier to offering international remittances for mobile network operators (MNO's), according to the GSMA. Together, WorldRemit and Huawei are lowering that barrier, enabling all Huawei partners to swiftly switch on this service.

"International remittance is a very important mobile money service in Africa, and our partnership with WorldRemit will bring international remittances directly to Huawei's customers across the continent," said David Chen, VP of Huawei Southern Africa.

"Huawei is committed to providing advanced mobile money platforms and technologies to global mobile money operators," said Ismail Ahmed, founder and CEO of WorldRemit. "We are delighted to add our remittance offering to Huawei's extensive range of services for mobile money providers. By making it easier to connect to our service, our partnership will accelerate our ability to introduce our safe, fast and low-cost remittance service to millions of people."

Huawei built its mobile money services platform to help deliver basic banking transactions in developing countries. The technology is not restricted, and because it works on both smartphones and basic handsets, it has been particularly successful in developing markets.