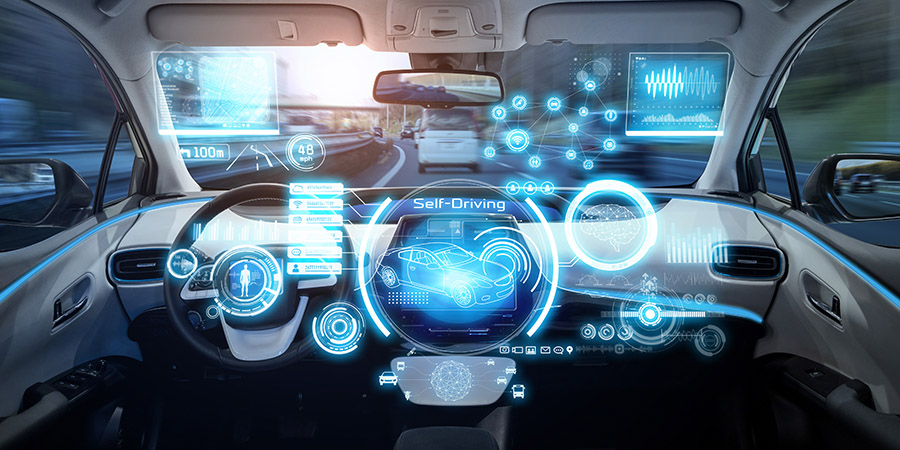

The stage is set and technology is ripe. Gone are the days to be shocked and awed by driverless cars traversing the highways. It is happening as we speak.

Going through some of the headlines from last year, it was interesting to see that significant strides in connected car technology have been evolving quickly and every car manufacturer (while there are some device manufacturers) in the world are in a hurry to turn this imaginary concept into a revved up reality.

Last year the groundwork was laid, from patents, partnership and fleets. The many activities in the so called ""third place"" have been very astounding. According to reports from last year, Apple has been buying up Apple Car domains though registration of the domains does not confirm the existence of an Apple Car. Apple is already offering its CarPlay platform to vehicle makers and these bulk registrations will stop domain squatters and would-be pranksters from confusing consumers. Reports from Reuters are highlighting Japan's Toyota as the global leader in the number of self-driving car patents, while next is Germany's Robert Bosch GmbH, then Japan's Denso Corp, Korea's Hyundai Motor Co and General Motors Co. For a tech-company, Alphabet Inc's Google ranks 26th on the list.

If last year was about patents, this year's CES Las Vegas was about partnerships. Though the event was filled with virtual reality, IoT and drones; connected cars were the attention grabbing thing and the focus of all attendees. With the recent announcement of a $500 million GM partnership with Lyft Inc, a Detroit-Silicon Valley partnership has been sealed and consumers are waiting for the first rollout of the touted on-demand ride-sharing service network of self-driving cars.

But one of the premiere events was the Faraday Future and the unveiling of a high performance electric concept race car. Also, some other highlights of the prestigious event were Volkswagen, which showed off its battery-powered Microbus to go on sale in 2017, and General Motors, which uncovered the final version of Chevrolet Bolt.

Regulating connected car

According to a GSMA report, the global connected car market is expected to grow three-folds within the next five years. They've noted that the global connected car market will be worth €39 billion in 2018 from €13 billion in 2012, according to new forecasts from research firm SBD and the GSMA.

To enable the market to achieve its full potential, the automotive and mobile industries need to work closely together to deliver scalable, secure, interoperable, ubiquitous and intuitive connected experiences.

The report noted that key areas to focus on are safety and security. Safety and security applications, such as eCall systems that alert the emergency services in the event of an accident, will be the most common feature supported by connected cars. They will be shipped in 41.7 million vehicles in 2018, according to the forecasts, which are up from 7 million in 2012. In the EU, Russia and Brazil, the widespread deployment of these safety systems will depend on the implementation of the aforementioned regulations.

Given all the activity in the field of connected cars, perhaps it is high time that the spotlight be given to connected car regulations. In fact, the past two years have been tedious for those concerned. Government bodies and agencies have been actively participating in creating the regulatory framework of connected cars.

According to research by international law firm, Freshfields Bruckhaus Deringer, they note that the connected cars regulatory roadmap is challenging. The rise of connected vehicles requires OEMs and suppliers to navigate a complex web of rapidly changing regulations. Different factors are to be addressed initially. Some relate to their choice of business model, others to the way they collect and process data. The development of self-driving cars is equally challenging, with the rules of the road evolving at different speeds around the world.

They noted that connected cars generate a huge amount of data, and it allows OEMs, suppliers and service providers to better understand a car's performance and the driver's behavior.

Data protection laws provide significant constraints to the use of this data. OEMs (original equipment manufacturer) can provide their own embedded connectivity systems or leave the customer relationship to third parties that determine how they are treated from a regulatory standpoint. In addition, any data associated with an individual is subject to the more than 70 data protection regimes around the world. And technological developments raise the risk that OEMs will have to comply with strict laws, including cyber-security regulation.

EMs (equipment manufacturers) and suppliers need to carefully consider data protection laws as part of the design process to avoid fines or worse, product recall, to ensure 'privacy by design'.

Another series of challenges would include current regulations that do not cater to full driverless technology. While on the other hand, regulators themselves need to make basic policy decisions soon so motorists can make the most of this technology.

For OEMs and suppliers, these new risk have yet to be quantified. Like the choice of test country for driverless technology, they need to consider a manufacturer's liability, with cyber-attack issues as part of a genuine risk.

Moving forward

In order to address regulatory challenges of connected cars, it is worth noting some of the key industries that are involved with connected cars.

According to Baker and McKenzie, connected cars reports key legal issues involve the following:

1. Telecom - these requirements may vary in different countries because contractual relationship exists between IT providers and mobile operators.

2. Data and privacy and security - the interplay between telecom and data protection regulation.

3. Insurance regulation - on where does the fault/liability lie if a self-driving car get into an accident? What are its coverage and its limitation/s?

4. Intellectual property - these are patent protection in terms of future innovations that spawn out from the technology.

5. Consumer protection - it is must be fair, complete and transparent information to consumers. Liability must be underlined.

6. Driver distraction and safety industry regulation - these are auto stop functionalities, vehicle warnings, placing of calls and use of location of buttons.

Though the connected car industry has miles ahead in terms of a defined regulation, there have been significant steps taken by government agencies that point to this direction.

As early as 2014, the US Department of Transportation's (DOT) and National Highway Traffic Safety Administration (NHTSA) started taking steps to enable vehicle-to-vehicle (V2V) communication technology for light vehicles. This technology would improve safety by allowing vehicles to ""talk"" to each other and ultimately avoid many crashes. They do this altogether by exchanging basic safety data, such as speed and position, ten times per second. This is a move that is prelude to connected cars communication.

Around the same time, the European Committee for Standardization (CEN) and the European Telecommunications Standards Institute (ETSI) issued an initial set of

standards for cooperative intelligence transport systems (C-ITS) called Release 1 following a request from the European Commission in 2009. Technical committees in both bodies continue to develop more standards on intelligent transport systems. In addition, authorities in Austria, Germany and the Netherlands have already agreed to cooperate to install roadside communication infrastructure.

Though these are just bits and pieces of the future of car regulations, technology development is gaining momentum at a very rapid pace. It is on this that government bodies and industry experts must step on the gas in order to keep pace and ensure that all ground has been fully covered before these cars finally rollout.