In this exclusive three-part series, Telecom Review will share valuable insights on the benchmarking of leading telecom vendors’ carrier and enterprise business operations.

In this part, we will review the telcos revenue performance from the data gathered from Twimbit's analysis titled "Benchmarking the performance of Top 19 Global Telcos in Q1 2023"

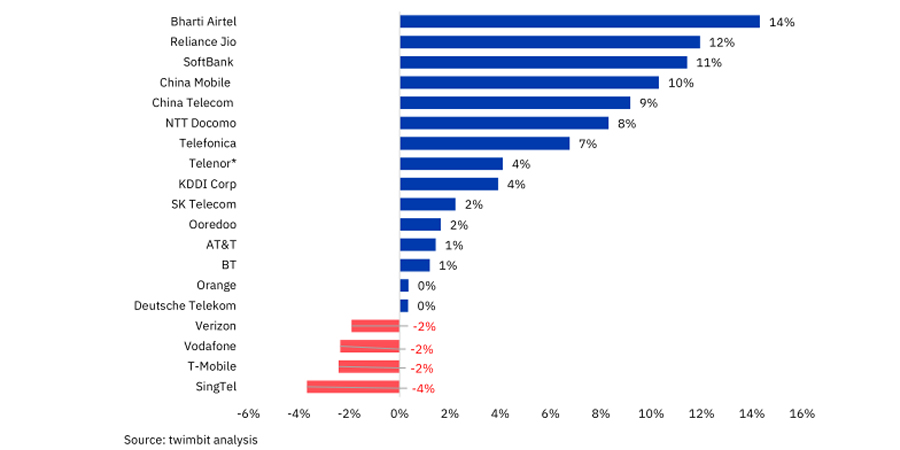

Bharti Airtel and Reliance Jio, prominent Indian telecom companies, demonstrated commendable YoY growth rates of 14% and 12%, respectively. While this growth rate represents a more modest pace compared to previous quarters, it still reflects a positive trajectory for both organizations.

The primary driver behind the moderate growth is attributed to constrained growth in ARPU. Notably, Reliance Jio in the prepaid category last made a substantial price adjustment of 25% in November and December 2021. Similarly, Bharti Airtel witnessed tariff increases of 20% in December 2021 and 15% in October 2022. Consequently, the full impact of the tariff hike has already been realized, resulting in stagnant ARPU figures for these telcos in the upcoming quarter when compared on a sequential basis.

China Mobile and China Telecom continued to build on their earlier momentum, achieving 10% and 9% growth rates, respectively. Such growth was driven by both companies’ effective implementation of comprehensive cloudification and digital transformation strategies, which contributed to their overall revenue increases.

Both prominent Japanese telcos, Softbank and NTT Docomo, achieved significant YoY growth rates of 11% and 8%, respectively.

The revenue growth for NTT Docomo was driven by its expansion into various sectors, such as Real Estate and Energy, in addition to its SI services.

Similarly, Softbank's revenue growth was primarily due to an increased adoption of IoT devices and the implementation of higher royalty rates in the smartphone market.

Telefonica reported growth across all business lines, with a YoY revenue increase of 7%. Particularly noteworthy is the strong growth in its B2B revenue, which saw a significant increase of 9%. Additionally, handset sales experienced a notable rise of 10.3%.

AT&T experienced positive YoY growth after reporting a revenue decline in the past three quarters. This growth can be attributed to consistent 5G and fiber customer additions, along with profitable growth driven by increasing wireless service and broadband revenue.

Verizon, Singtel, Vodafone and T-Mobile reported a decline in revenue during Q1 2023. Verizon's revenue declined by 2% YoY due to lower wireline and wireless equipment revenue. However, this decline was offset to some extent by growth in wireless service revenue.

Singtel's consumer business in Singapore showed positive momentum, driven by increased mobile service revenue, particularly from higher roaming usage, increased adoption of 5G and a growth in prepaid sales. However, this growth was insufficient to offset the overall decline in group revenues.

Vodafone's revenue performance slowdown was in line with expectations and can be attributed to a decline in service revenue growth. While this decline may seem challenging, it aligns with the company's projected forecasts.

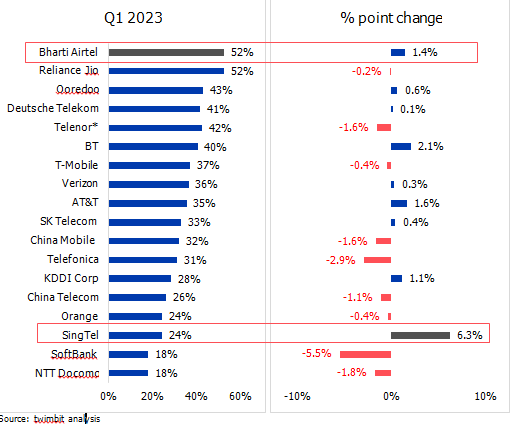

EBITDA performance in Q1 2023

EBITDA performance, Q1 2023

Bharti Airtel and Reliance Jio, leading Indian telcos, maintained a robust EBITDA margin (above 50%), showcasing their strong financial performance. Meanwhile, Softbank and NTT Docomo, prominent Japanese telcos, have demonstrated consistent growth, despite having slightly lower EBITDA margins compared to their global counterparts.

Interestingly, almost 50% of the telcos covered in the analysis experienced an improvement in EBITDA margins.

Singtel witnessed a substantial increase of 630 basis points in EBITDA margin, reaching 24% in Q1 2023. This performance was driven by the increased revenue from fixed broadband services, fueled by higher-speed broadband plans.

Telefonica and Softbank were major telcos that experienced a decline in EBITDA margins during Q1 2023.

Telefonica encountered a decline of 290 basis points in EBITDA margin, primarily attributed to a one-time capital gain recorded in Q1 2022. However, this decline was partially offset by positive forex effects and lower restructuring costs.

Softbank's EBITDA margin decreased by 550 basis points, mainly due to a one-time gain resulting from the step acquisition involving the conversion of PayPay Corporation into a subsidiary.

Also read: Telcos in Q1 2023: 5G Deployments Continued to Increase CAPEX for Leading Performers