Never-ending human curiosity has brought about the advancement and evolution of information technology to its current form. With this ever-expanding information exchange taking place through telecom networks and its affiliations, AI is finding its way into businesses, promising to improve operational efficiencies and ultimately enrich the customer experience at every touchpoint. From autonomous driving to hyper-personalized healthcare, the amount of data generation from such activities is staggering.

According to Statista, the volume of data created, captured, copied, and consumed worldwide grew over the previous decade from 2 zettabytes to 64.2 zettabytes. As such, this surge in data volume is testing the capacity of computer memory chips to process them into useful information.

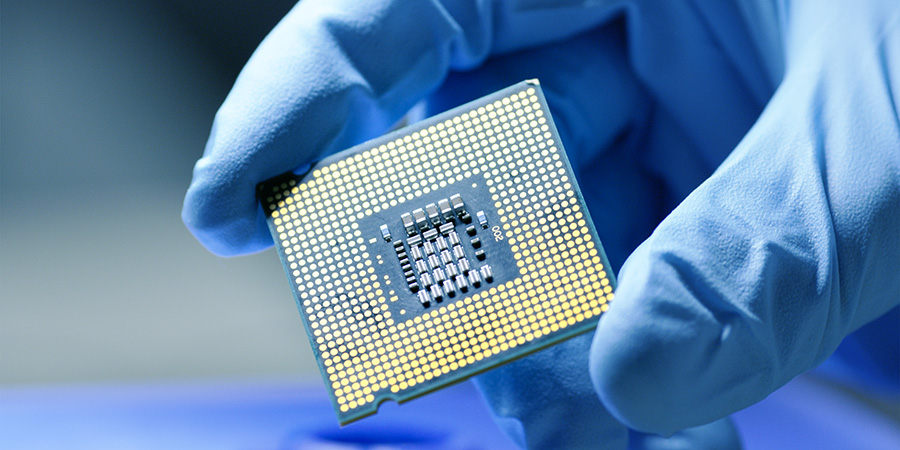

Modern computers have separate memory chips for computing and data storage. However, the connections between the two are limited to handle the growing volumes of data, thus, creating a critical communication ‘bottleneck,’ according to experts. Furthermore, the silicon-based transistors, which form the foundation of underlying devices, are not progressing at a rate parallel to addressing the surge in data volume.

Also Read: Saudi Arabia Launches SAR 1 Billion Fund to Boost Semiconductor Industry

Breakthrough Attempts

Confronted with these challenges, engineers at MIT took action in 2017 by developing a prototype chip that integrates over 1 million resistive random-access memory (RRAM) cells—a nonvolatile memory technology that operates by altering the resistance of a solid dielectric material—and 2 million carbon nanotube field-effect transistors. This innovative approach resulted in a new, densely packed 3D computer architecture featuring interleaving layers of logic and memory.

Importantly, this advancement has effectively overcome the limitation of transferring data between separate chips. However, achieving such an architecture is not feasible with existing silicon-based technology, as the circuits are limited to 2D, presenting significant fabrication and design challenges. Work is underway to improve the core nanotechnologies while exploring the new 3D computer architecture.

Also Read: Dubai Elevates AI Governance with 22 Chief AI Officers

Battle for Memory

Given the demand for High Bandwidth Memory (HBM) driven by AI chips, South Korean memory giant, SK Hynix, is reportedly planning to upgrade part of its dynamic random-access memory (DRAM) production equipment at its Wuxi plant to the fourth-generation of a 10-nanometer process this year, according to research group, TrendForce. In its upcoming iteration, SK Hynix's fifth-generation HBM (HBM3E) product boasts a maximum capacity of 36 GB (288 Gb), achieved by stacking 12 chips of 24 GB DRAM.

Likewise, Micron Technology, the world's third-largest chip maker, announced that its high-bandwidth memory (HBM) chips—renowned for their ultrafast performance and crucial role in AI application development—are completely sold out for the entirety of 2024. Moreover, a significant portion of Micron's supply for 2025 has already been allocated.

Samsung Electronics, the world’s top memory chipmaker, plans to introduce three-dimensional (3D) DRAM. This technology is expected to revolutionize the artificial intelligence (AI) industry by 2025 and lead the global AI semiconductor market (which is currently dominated by SK Hynix Inc).

A 3D DRAM chip triples the capacity per unit area by stacking cells vertically rather than placing them horizontally. Furthermore, high bandwidth memory (HBM) employs vertical interconnections to link multiple DRAM chips.

The 3D DRAM design enables an increase in capacity within a single chip area, as it can accommodate more cells within the same space. The basic capacity of 3D DRAM is 100 gigabytes (GB), nearly triple the 36 GB maximum capacity of the currently available DRAM.

The global 3D DRAM market is expected to reach USD 100 billion by 2030, according to industry sources. Meanwhile, industry watchers are closely observing the sprouting 3D DRAM market.

Interesting Read: Rolling in the Chip: A Semiconductor Quandary

Key Drivers

One of the key factors driving the semiconductor memory market is the increasing use of memory-based elements in technologically advanced products, such as smartphones, wearable devices, and electronic gadgets. In this segment, Chinese tech giant, Huawei, released the Mate 60 smartphone, which utilizes a 7-nanometer process chip, which is considered highly advanced.

Semiconductors are increasingly being used in automotive and electronic systems, including flash read-only memory (ROM) and DRAM, contributing to the market's growth. The utilization of the Internet of Things (IoT) and edge computing in smart city projects as well as industrial applications is also impacting the market.

Furthermore, there is a growing demand for semiconductor memory chips with large storage capacities to cater to the expanding colocation data centers and hyperscale data environments in industrialized nations. This surge in demand is being propelled by the need for robust connectivity, efficient data management, and expansive storage capabilities to handle the massive volumes of corporate data generated by mega facilities.

In Conclusion

From the implementation of biometric systems for immigration purposes at international airports to predicting natural disasters like forest fires and floods, the role of AI is poised to be all-pervasive, across industrial sectors. The semiconductor memory market size was valued at USD 172.0 billion in 2023 and is expected to rise to USD 354.5 billion by 2033; and sales are expected to expand at a significant CAGR of 7.5% during the forecast period, according to the latest market findings.

In the race for AI supremacy, Japan has approved subsidies worth 590 billion yen (USD 3.9 billion) for chip foundry venture, Rapidus, to rebuild the country's chip manufacturing base. Consequently, billions of dollars are being invested by chip makers including Nvidia, Qualcomm, IBM and more, in order to enhance the prerequisite resources for chip manufacturing, including human skill development.

Interestingly, within the semiconductor market, the supply chain plays a critical role in the production process. Ensuring equitable access to advanced chip-making technology is essential for boosting production efficiency, reducing costs, and saving time. This equitable access will be pivotal in enhancing the market competitiveness of semiconductor manufacturing countries. Furthermore, restrictions on the import and export of resources between semiconductor player countries will remain a challenge in terms of the growth of the industry.

It will be interesting to see if Rapidus can rival Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest contract chipmaker, whose expertise in developing semiconductors remains undisputed. The company earned 60% (or nearly USD 17 billion) of semiconductor foundry revenue in Q1 2023.