Vodafone Qatar announced its financial results for full year 2021, showing a double-digit increase across indicators which reflects the company’s success in maintaining its growth trajectory.

Commenting on the results, Vodafone Qatar’s chairman, HE Abdulla Nasser Al Misnad said, “Vodafone Qatar started 2021 by making further significant investments to enhance and expand its network, which allowed us to better support all of our consumer and business customers across Qatar. We have also worked hard to continue adapting to the new landscape in which we are now operating in as a business, due to the long-term impact of the COVID-19 pandemic, as well as set ourselves up for the future. Now, through our efforts to proactively accelerate and promote the digital transformation of Qatar, we look forward to playing a pivotal role in what is set to be a very productive year for both our company and the country.”

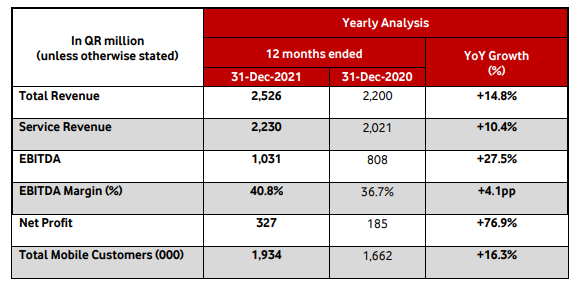

The company reported an annual net profit of QR 327 million, a 77% increase compared to the previous year mainly driven by EBITDA growth, despite the impact of COVID-19. Total revenue for the year also increased by 14.8% year-on-year to reach QR 2.5 billion due to continued growth in the company’s postpaid, fixed broadband services (GigaHome), managed services and equipment, and related services.

Rashid Fahad Al Naimi, Vodafone Qatar managing director added, “Vodafone Qatar finished 2021 with a 76.9% increase in net profit year-on-year and with 16 consecutive quarters of higher year-on-year revenue. This, despite the sustained impact of the COVID-19 pandemic on global markets and headwinds that continue to erode the overall market value of the telecommunications industry worldwide. The transformation strategy that Vodafone introduced in 2018 is still in its implementation phase, and its effectiveness can be seen through the trend of constant growth that we have achieved in the past year. The company is consistently improving the returns it provides to its shareholders, which is led by revenue growth and continued cost control, and we are confident that we will be able to continue to do so in 2022 and beyond.”

Moreover, service revenue grew by 10.4% to QR 2.2 billion. Vodafone Qatar is now serving 1.9 million mobile customers representing a growth of 16.3% compared to last year. EBITDA also surpassed QR 1 billion reflecting a strong growth of QR 223 million or 27.5% compared to last year, positively impacted by the higher service revenue and the continued cost optimization program.

HE Sheikh Hamad Abdulla Jassim Al Thani, CEO, Vodafone Qatar, elaborated, “2021 was an exceptional year for Vodafone Qatar. Thanks to our clear business strategy, and by relying on innovation we have been able to continue moving towards our desired goals at an ever-increasing pace. We increased our efforts to develop and enhance our industry-leading network, especially with regards to our 5G capabilities. We expect these investments to continue to support Qatar’s digital infrastructure and open up opportunities to deploy smart city applications, with the use of emerging technologies such as the Internet of Things (IoT) and Augmented Reality (AR). These will, in turn, drive digital transformation across the country.”

With Vodafone Qatar’s new business vision revolving around combining technology with the human spirit, they aim to enhance being a communications service provider by being an active player in the digital sector as a whole. “When fostering innovation and creativity, we rely on this human element and on close collaboration between all parties. As a result, our efforts, in cooperation with our partners, have proven that together we can build a sustainable and prosperous future for all residents and citizens of Qatar,” continued Al Thani.

Consequently, the EBITDA margin improved by 4.1 percentage points (pp) to reach 40.8%. Based on Vodafone Qatar’s commitment to enhance shareholder value and the strong financial performance, the board of directors has recommended the distribution of a cash dividend of 6% of the nominal share value which will be presented at the company’s next annual general assembly for approval.