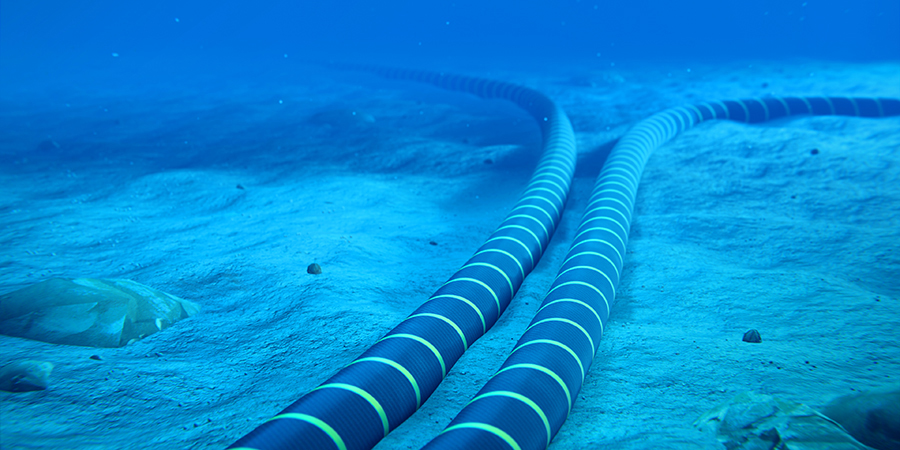

Hidden from the eyes and not quite understood by many, connectivity in the modern era relies heavily underneath on subsea cables, not only on the cloud. As a matter of fact, for networks to work, they cannot depend on one side of technology anymore. The interconnectedness is brought by combining the wireless landscape powered by 5G, AI/ML, cloud, IoT, and network automation to the fiber-optic infrastructure lying on the ocean floor.

As of August 2021, TeleGeography has recorded over 1.3 million kilometers of submarine cables in service globally. Along with this, more than $8 billion in new cable investments would be spent over the next three years.

The race is mainly fierce in both the Pacific and Atlantic oceans, which is also connecting Asia to the Middle East or African shores. With continuous investments, Africa and the Middle East are now among the ideal points for landing stations within 464 cables and 1245 landing stations (some are still under construction).

Why subsea cable investments are growing

According to the World Development Report 2021, yearly total internet traffic is projected to increase by about 50 percent from 2020 levels. Thus, by 2022, it might reach up to 4.8 zettabytes, equal to 150,000 GB per second. That would mean 32 GB spent from each person on the planet per month and 325 million households watching Netflix simultaneously, at all times.

Without a doubt, this growth in global internet traffic translates to a massive volume of data transmitted across borders. The process of transmission mainly happens undersea, bringing the innovation within the submarine cable industry into a boost.

This network of submarine cables transports millions of information around the world on a daily basis, in a manner that is invisible to the public. Embedded underneath, these submarine cables were primarily built by telecom carriers. Later on, undersea cables began to attract investment from private companies. They saw the potential of making handsome profits by selling more capacity.

Today, the investment landscape in undersea cables has shifted as more cloud and content service providers get more involved in the production, transmittal, and repositing of subsea cable data traffic. In fact, Google, Facebook, Amazon, and Microsoft owned or leased more than half of the undersea bandwidth in 2018 and now, they are making headlines from building submarine cables that run from West to East.

Certain routes such as the Atlantic or the Pacific appear to have a higher concentration of content provider investment as they aim to establish links on where their largest data centers are located – in Europe and Asia back to the United States. This is in line with Alan Mauldin’s statement (TeleGeography’s research director) on why hyperscalers need so much capacity for shuttling data across the ocean. Around the world, they have actually invested roughly about $20 billion in new cables that land in places previously not considered when carriers made these decisions based solely on their own needs.

In this day and age, both telecom operators and content providers are deep-rooted into subsea investments to cater to the unstoppable demands of global data flows. As technological advancements continue within the fourth industrial revolution, these submerged cables would be more important than at any other time.

MENA subsea cables: Then and now

More than two decades have passed since SeaMe We-3, the world’s longest submarine cable system at 39,000 km, linked 39 cable landing stations in 33 countries across Asia, Australia, Africa, and Europe. It is supplied by Alcatel Submarine Networks (ASN) and Fujitsu and is owned by an international consortium of nearly 100 telecom operators.

Since then, subsea cable systems around the world have been built. Connecting Asia-Europe-Africa, some of the launched systems include PEACE, SEA-ME-WE 4, SEACOM, EASSy, SAFE, MENA-SCS, GBICS, AAE-1, SEA-ME-WE 5, METISS, and EPEG. On the other hand, trans-Atlantic subsea systems comprise Dunant, AEConnect/AEC-1, HAVFRUE/AEC-2, and MAREA, among others. Google, Facebook, and Amazon have all invested in these cables.

Focusing on the MENA region, a stronger footprint that addresses the need for higher levels of fiber connectivity is anticipated. Not to mention an improved coverage of subsea cables, cable landing stations, exchange nodes, and edge data centers.

MENA serves as both an important node and a crucial transitway for international capacity and in the years to come, here are some of the most-awaited subsea cables to be ready for service (RFS) within this area:

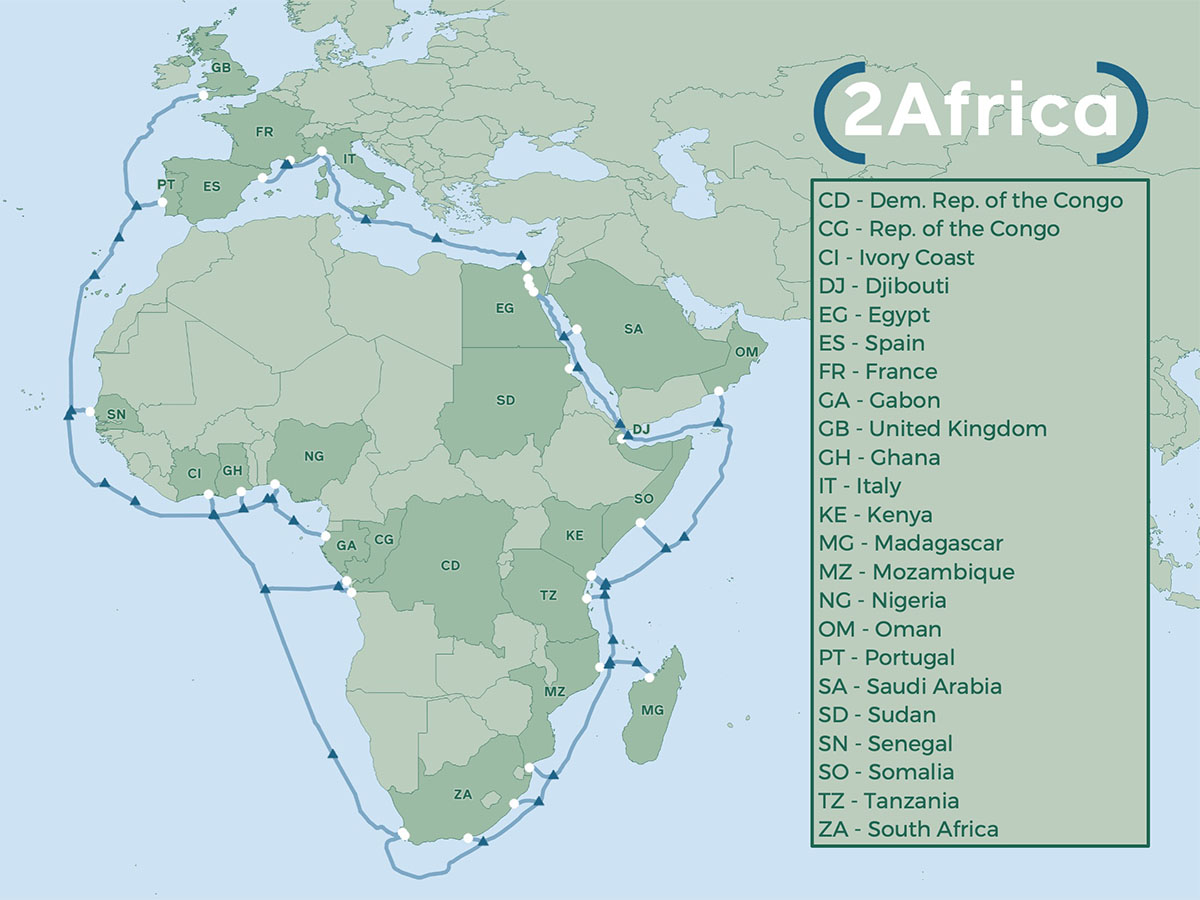

- 2Africa (2023)

Hailed to be the largest subsea cable project at present-day, 2Africa (originally announced as Project Simba in 2019), stretches to 45,000 km long and aims to connect 3 billion people in 33 countries. Set to be RFS in late 2023, the 2Africa consortium, comprised of Facebook, MTN GlobalConnect, China Mobile International, Orange, stc, Telecom Egypt, Vodafone, and WIOCC, has made considerable progress in planning and preparing for the cable’s deployment.

The goal is to surround the African continent with undersea data fiber, extending branches to Europe and the Middle East. It includes other strategic locations like Seychelles, Comoro Islands, Angola, and Nigeria as well. 2Africa will deliver faster, more reliable internet service to each country where it lands with its cable landings made available to service providers at carrier-neutral data centers on a fair and equitable basis.

The 2Africa cable is designed to improve resilience and maximize performance by implementing ASN’s SDM1 technology from ASN that allows deployment of up to 16 fiber pairs and including a seamless optical crossing between East Africa and Europe. Overall, businesses and consumers will benefit from enhanced capacity and reliability for services such as telecommuting, HD TV broadcasting, internet services, video conferencing, advanced multimedia, and mobile video applications.

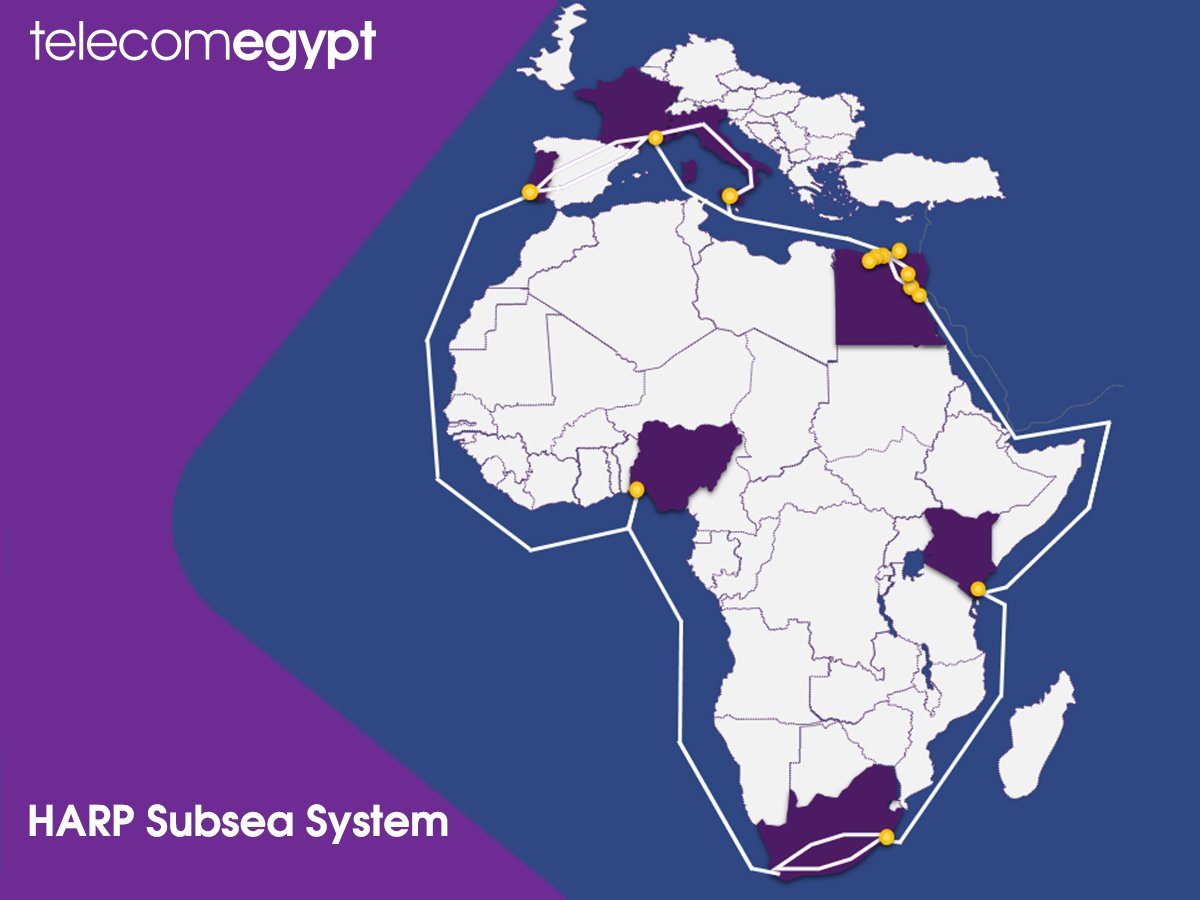

- HARP (2023)

The Hybrid African Ring Path (HARP) subsea cable system will also connect the entire continent of Africa. It would create landing points in three southern European countries — Portugal, France, and Italy. Aside from this, HARP’s route will have Sharm El Sheikh serving as a new landing point and will be connected to coastal cities on the Gulf of Suez. This would form a hybrid terrestrial and subsea fiber connectivity solution between landing points in Egypt.

Launched by Telecom Egypt and set to complete by 2023, HARP will form two main arteries: the first will run upwards from the southern tip along the east coast and into France and Italy while the second will run along the west coast into Portugal; overall forming a harp-shaped structure.

Shaping a complete ring around the continent, the HARP system will leverage branching out multiple landing points via diverse and resilient subsea segments. Furthermore, it will enable a wide range of capacity solutions based on two-and-three layer architecture.

- Africa-1 (2023)

Backed by a consortium involving Etisalat, G42, Mobily, Pakistan Telecommunication Company, and Telecom Egypt, the 10,000 km transocean system will deliver 8 fiber pairs to connect Africa and the Middle East eastward to Pakistan and westward to Europe. The cable will also feature ASN’s 1620 Softnode transmission equipment that would highly increase the available transmission capacity between Asia and Europe.

The Africa-1 submarine cable system has initial landings set in Egypt, France, Kenya, Djibouti, Pakistan, UAE, and KSA. Moreover, it will also land in Sudan, cross Egypt through diverse new terrestrial routes on the way to France, and further connect other countries in the Mediterranean such as Algeria, Tunisia, and Italy.

Expected to be RFS by the end of 2023, the Africa-1 system’s next phase will include additional landings in Yemen and Somalia, with intermediate landings in Tanzania and Mozambique. It will support Africa, the Middle East, Pakistan, and other Asian countries on their journey to digital transformation and will make it possible to transport ever-increasing volumes of traffic between the three continents.

- Blue-Raman (2024)

Google collaborates with Sparkle, Omantel, and others to build and operate two additional submarine cable systems: Blue-Raman. It particularly links the Middle East with southern Europe and Asia. To be specific, Italy, France, Greece, and Israel will be connected via the Blue submarine cable while the Raman submarine cable covers Jordan, Saudi Arabia, Djibouti, Oman, and India.

Developing additional network capacity and routes is critical to power online lives and communicate with friends, family, and business partners, said Bikash Koley, VP and Head of Google Global Networking. The Blue-Raman cable will cost about $400 million, aiming to be a creative route connecting Asia and Europe via Israel and Jordan, bypassing the crowded Egypt route.

Each equipped with 16 fiber optic pairs, the Blue-Raman cables are expected to be RFS in 2024. In time, additional landings will be made to connect the two systems through terrestrial network assets. As announced, Sparkle's BlueMed cable shares fiber pairs and a wet segment of the Blue cable system.

MENA as a vital subsea landing hub

At the moment, subsea cables loop around the Gulf, heading to Asia, out into the Mediterranean, and to Europe and beyond. Do these carry a huge amount of voice and data traffic? On a global scale, 95% of the world’s internet traffic runs over subsea cables. As internet traffic continues to expand, these cable systems will become greater in number and increasingly critical for the global economy, including the Middle East.

The Middle East and North Africa region is known as a hub for oil, shipping, and commerce routes. Nowadays, it is data and communications that flow through its busy waters. Trade routes have become cable lines that carry billions of pieces of data per second. Each landing site is where the cables connect to a country and link together, forming a global network under the sea.

Out of all countries within the region, Egypt stands out as it is central to global internet connectivity. Many cables connecting Europe to Asia, the Middle East and the east coast of Africa, cross the country from the Mediterranean down the Red Sea.

Where cable systems land, technology industries grow and flourish further. Being among the front liners in digital transformation, Middle East and African countries are diversifying their economies to become more advanced and maintain competitiveness across the ICT sector. Africa is seen as a subsea wonderland for many due to its strategic location and rising demand for internet access. While offering multiple options at reasonable prices, continued submarine cable network development will ensure that MENA has a robust connectivity infrastructure that can be sustainable for future generations.