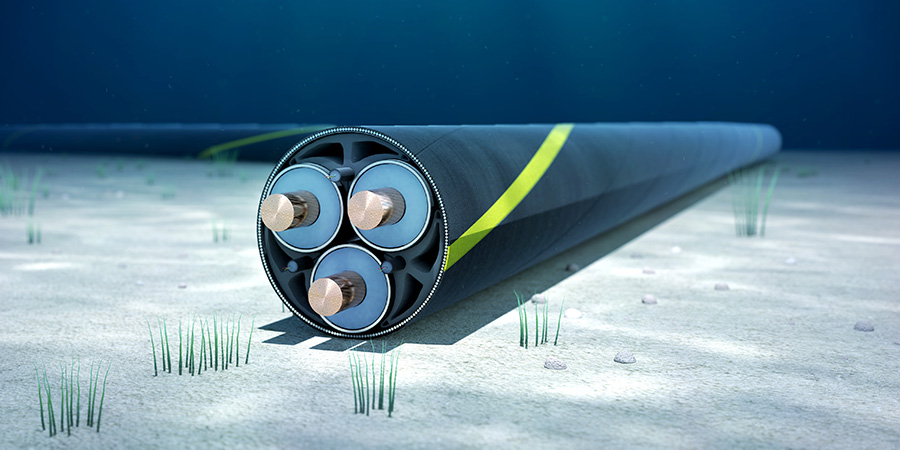

Even though there are currently over 1.4 million kilometers of subsea cables crisscrossing the ocean, the demand for more resilient, high-capacity networks is continuing to surge by a compound annual growth rate (CAGR) of 7.1%. In an era where artificial intelligence (AI)-driven technologies are impacting data usage and storage, subsea cables are more critical now than ever before as they power everything from cloud services to real-time analytics.

This year at the World Economic Forum in Davos, global leaders discussed the evolving complexity of the cyber landscape in the wake of its rapid growth as a result of emerging technologies, geopolitical upheavals, uncertainty in supply chains, and a shortage in cyber skills. Additionally, a new report detailing AI and its responsible adoption at scale across key industries and practical strategies for inclusive AI development was unveiled.

Such timely groundwork is a clear indication of the volume of data that networks will need to support AI-driven operations of the future.

The MENA region is experiencing an unprecedented demand for advanced fiber infrastructure to support AI-driven technologies. Hence, international and regional infrastructure that provides intercontinental connectivity is vital. Given this demand, it’s no surprise that the MENA region has become the hub for major international submarine cable infrastructure to achieve a broader reach.

Analysis: The Atlantis of Connectivity: Subsea Cables

The Growing Need for Connectivity

The total mobile data traffic in the Middle East and North Africa (MENA) region was forecast to increase from 9.1 exabytes per month in 2024 to about 28 exabytes per month by 2030, representing a trifold expansion over the next six years.

In recent news, Jordan’s Telecommunications Regulatory Commission (TRC) announced that the number of fiber optic subscriptions in Jordan reached approximately 556,350 by the second quarter of 2024. Additionally, the TRC’s report revealed that total fixed broadband subscriptions in Jordan reached 793,740 by the second quarter of 2024. Such developments indicate the growth of consumers in indoor settings.

Despite the increase in internet usage in recent years, 35% of the global population lacks efficient access to the internet. Moreover, this percentage increases to 54% in low- and lower-middle-income countries (LLMICs), primarily due to the absence of necessary infrastructure. To counteract this, the ITU, along with the Digital Infrastructure Investment Initiative (DIII) recommends extending the connectivity backbone in LLMICs by 1.7 million kilometers to match upper-middle-income countries (UMICs).

To make the most of the emerging technologies, operators need to replace their legacy systems with modern, end-to-end solutions to offer unique packages across various customer segments. The efficient data processing of such ever-growing activity will warrant unfailing and ubiquitous connectivity. Hence, robust intercontinental subsea networks are vital for the future of digital services.

Read More: Connecting the Corld through Subsea Cable Systems

Some Notable Deployments Across MENA

Reflecting such trends, one notable development has been the agreement between Gulf Bridge International (GBI) and iQ Networks (iQ), both of which signed Iraq’s first Indefeasible Right of Use (IRU) dark fiber framework into effect to establish Iraq as an essential telecommunications hub. With this development, the Silk Route Transit surpasses 1 Tbps of capacity, underscoring the impressive potential and reliability of iQ’s infrastructure.

Inaugurated in 2010, the Silk Route Transit consists of over 2,000 kilometers of fiber-optic cable laid across Iraq. Its multilayer fiber-optic network provides the shortest alternative terrestrial route connecting Europe to Asia and will enable users to have high-quality and low-latency-based experiences.

In another instance, the US Trade and Development Agency (USTDA) has awarded a grant to Nigeria’s Federal Ministry of Communications, Innovation and Digital Economy (FMCIDE) to conduct a feasibility study that aims to expand internet access to 12 million Nigerians. This initiative involves deploying 90,000 kilometers of new fiber optic backbone infrastructure across Nigeria.

Furthermore, major projects are adding capacity to emerging and high-growth markets such as Africa (2Africa, Equiano), the Middle East (Oman Australia Cable) and India (India-Asia-Xpress and India-Europe-Xpress), representing a major step toward closing the digital divide globally. However, even well-established subsea cable corridors require new construction to keep pace with growing demand.

Related: The Mission of Landing a Submarine Cable

AI’s Influence: New Challenges for Subsea Cables

Telcos stand to benefit from using AI to enhance revenue generation, optimize networks, generate marketing strategies, bolster customer experience, and improve overall operational efficiency. Can those developing subsea cables utilize the same approach?

Sustainability: All future subsea projects must balance the ever-growing demand for capacity with the sustainability targets of the organizations that will use that capacity. This means that all elements of the network—including the subsea cables—need to be built using efficient design principles and powered using renewable energy. For example, Huawei used Ethernet technology to create a simplified, low-latency data center network technology stack, reducing energy usage in subsea cable functionality and catering to sustainability goals.

Reliability: Subsea cables are an extension of original internet infrastructure, which, by nature, share a transmission medium. Given the modern focus on virtual environments, subsea cables will need to offer both high capacity and reliability to support these solutions. To do so, cable operators can use AI-driven smart cable technology to detect outages. They can also leverage generative AI (GenAI) to enhance network operations using a domain-expertise layer consisting of reliable broadband sources. By analyzing the data collected from connected sensors using AI, operators can locate the problem, identify when it occurs, and minimize disruption with quick response times.

Cybersecurity: Subsea cable operators are facing new cybersecurity threats. As the volume of sensitive data being transferred through these cables rises, the potential of cyberattacks in the form of cable tapping or data theft is increasing. To combat this danger, underwater cable operators are collaborating with cybersecurity specialists to create new security measures and increase network resiliency.

For example, Fincantieri and Telecom Italia's Sparkle have partnered to develop surveillance and protection solutions for subsea cables. Meanwhile, NATO's Operation Baltic Sentry employs elite divers, submersible drones, and naval vessels in the Baltic Sea to address sabotage threats to underwater cables. The Quad Partnership for Cable Connectivity and Resilience exemplifies this approach—it demonstrates how international cooperation can bolster submarine cable security in strategically important regions.

Optical Technology Upgrades: Optical technology usage in the undersea cable market is not uncommon; however, advances in optical modulation and multiplexing techniques are allowing more data to be sent across these fibers, enabling greater capacity and quicker transmission rates. For instance, advanced, submersible, reconfigurable optical add/drop multiplexers (OADMs) equipped with wavelength-selective switch technology enable gridless and flexible bandwidth configurations. Based on space-division multiplexing design, this innovation allows the cable to optimize bandwidth use and scalability efficiently.

Landing Stations: The growing requirement for connectivity is necessitating the creation of new landing stations. In recent years, there have been efforts to construct additional landing sites in underserved areas such as isolated islands, coastal cities, and rural areas, linking them to the global communication network with high-speed internet services. The Middle East has seen significant subsea landing developments, with stc Bahrain and center3 landing the 2Africa Pearls cable in Bahrain, Zain KSA and Emaar collaborating on the J2M cable landing in KAEC, and Mobily and Telecom Egypt completing the first Saudi-owned subsea cable through the Red Sea, contributing to 2Africa becoming the world’s longest subsea cable system. However, these locations sometimes experience geopolitical tension and getting permission to build landing hubs can be extremely difficult.

In Conclusion

A robust communication infrastructure lies at the core of today’s digital transformation. Submarine cable systems are responsible for carrying almost 97% of the world’s internet traffic. The connectivity provided by subsea cables, along with terrestrial fiber networks and satellite communication, is linking people and businesses across the globe.

In this ever-growing hyperconnected world, new challenges will keep emerging as the industry evolves. As such, subsea cables must constantly adapt to keep pace with growing consumer needs.

Related: The USD 1.6 Trillion Mission: Building Digital Infrastructure for All